Open Banking New Zealand Framework

Unlock New Zealand's Consumer Data Right (CDR) Open Banking Compliance with Cloudentity's Trusted OAuth & Consent Platform

With Cloudentity, your organization will be able to:

- Securely share financial data over APIs

- Instantly meet security and consent compliance requirements

- Seamlessly integrate and enable third-party developers

- Lower your overall New Zealand Open Banking implementation cost

- Get constant updates as the ecosystem evolves

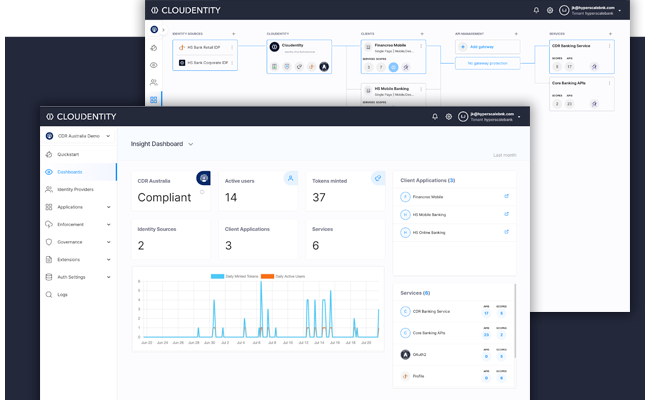

The Cloudentity PLATFORM offers a high performance, multi-tenant, advanced FAPI compliant and certified authorization server built on open standards and compatible with advanced OAuth 2.0 & OIDC specifications. Cloudentity also provides a rich set of APIs that facilitates consent collection and secure customer journey experiences. Our platform is certified in 35+ OIDF FAPI profiles.

Your Path to Open Banking Success with Cloudentity in New Zealand

Welcome to Cloudentity, Your Open Banking Partner!

Discover why leading New Zealand companies choose Cloudentity:

Join the Open Banking Revolution with Cloudentity.

Contact us today for innovation and success!

Discover why leading New Zealand companies choose Cloudentity:

Expertise

Our unmatched Open Banking expertise ensures your seamless transition with support for FAPI 1.0 and FAPI 2.0 compliance.

Trusted

As industry leaders in Australia, we bring proven solutions for secure, compliant, and innovative Open Banking experiences.

Integration

Seamlessly integrate our platform with your infrastructure, saving time and resources.

Security

We prioritize data protection with SOC2 and ISO-certified infrastructure, ensuring top-tier security and compliance.

Ahead of Regulations

Stay ahead of regulatory changes with our experience in Australia, closely aligning with New Zealand's future rules.

Contact us today for innovation and success!