Compliance, OAuth and Consent for FDX

Security for the open exchange of financial data

FDX Compliance for Financial Institutions

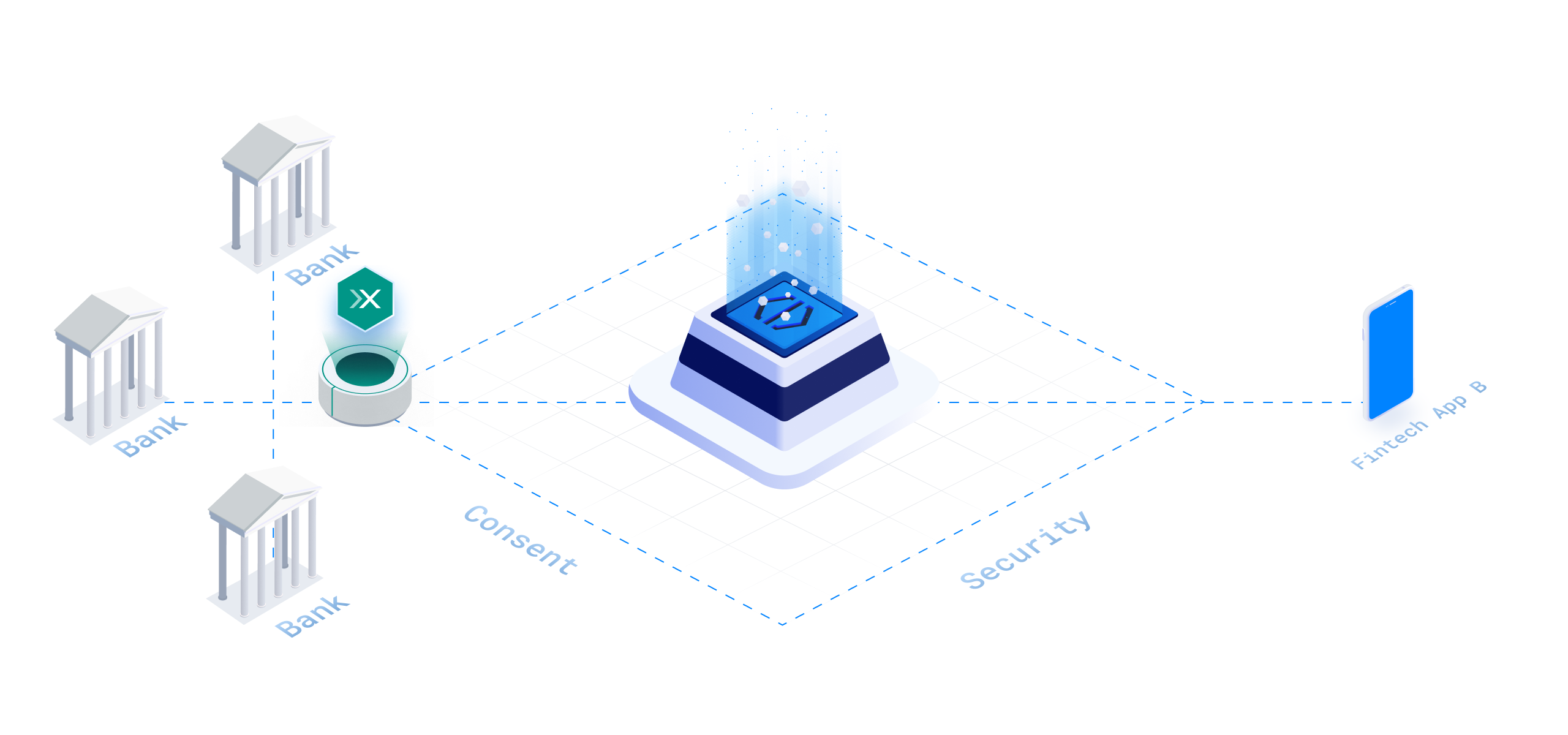

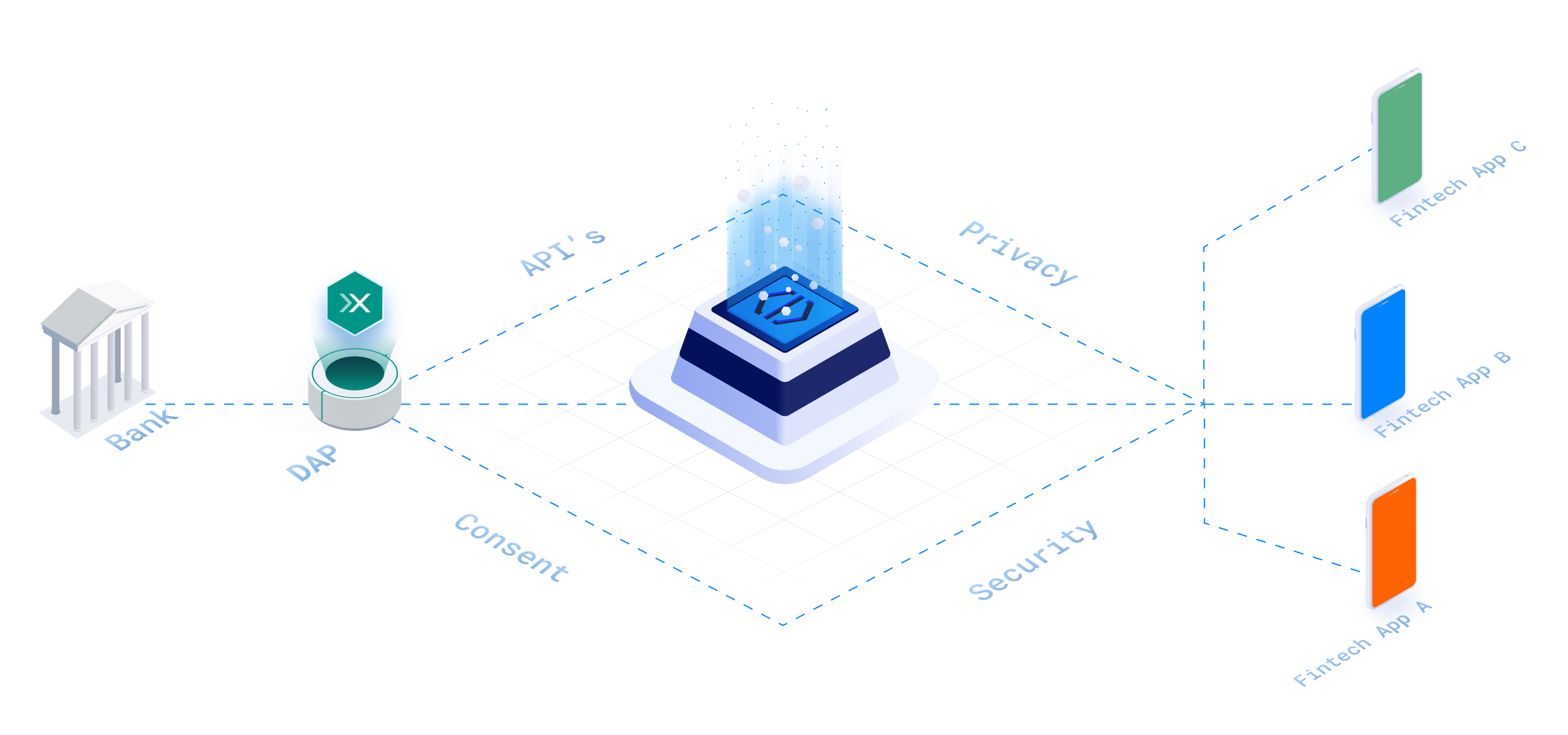

Data exchange over APIs in open finance ecosystems is made safe and private via the implementation of standards-based security and consent profiles. While sharing data over APIs within a financial institution has become common, meeting the security and consent requirements to safely and privately share customer data with third parties can be daunting.

The Cloudentity platform enables financial institutions to INSTANTLY MEET the security and consent requirements set forth by FDX. Building on our support for worldwide Open Finance standards, including FAPI 2.0, Open Banking UK, Open Finance Brazil and Australia's Consumer Data Right (CDR).

Cloudentity is the first and only SaaS platform to provide instant compliance with the required FDX security and consent profiles so that financial institutions can quickly join the FDX ecosystem in its early stages. Cloudentity's SaaS platform stays steadily compliant as the FDX specification evolves, so our customers can be confident their FDX implementation will remain seamlessly up-to-date.

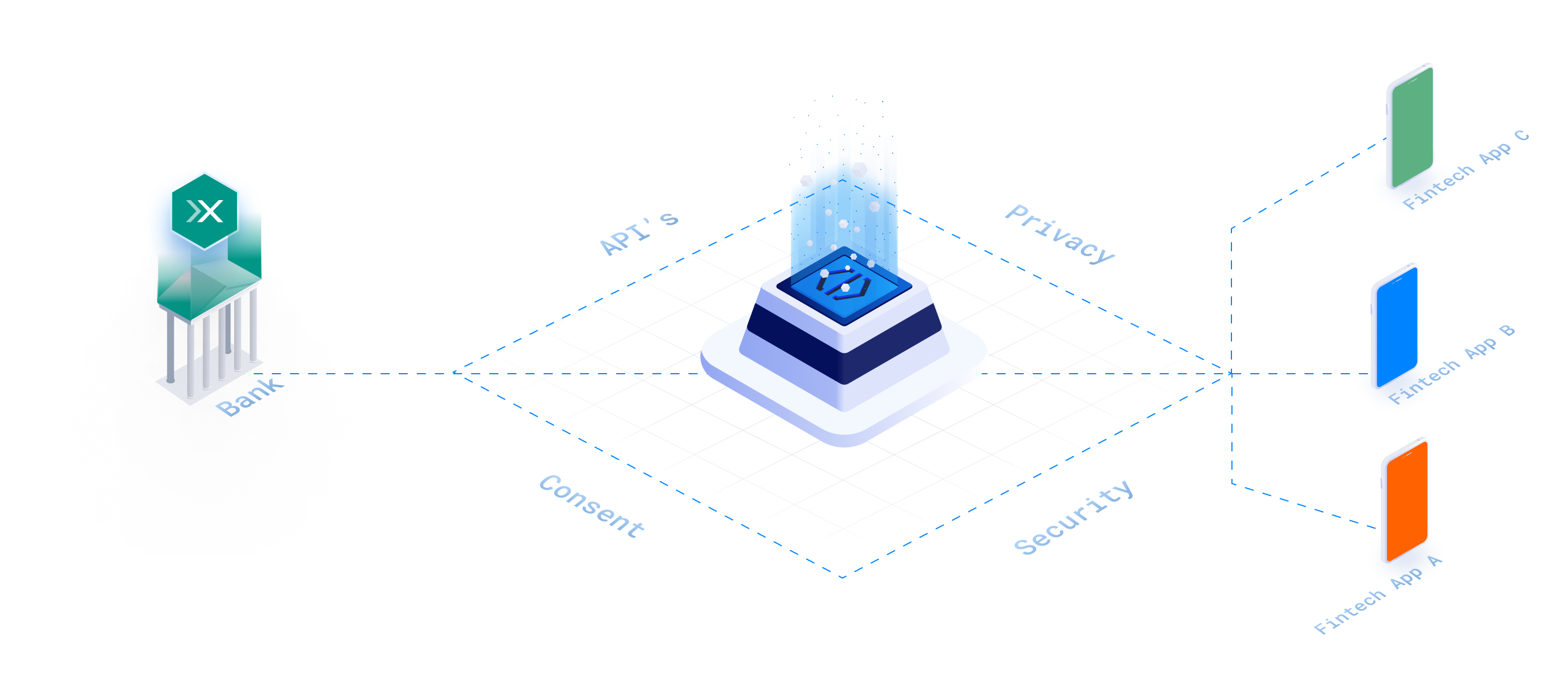

FDX Security and Consent for Data Access Platforms

Data access platforms help financial institutions minimize costs and reduce time to market with end-to-end compliance solutions. These platforms can leverage Cloudentity to implement the OAuth security and consent profiles required by FDX, providing shared multi-tenant data access options to better service their financial institution customers. Learn more

FDX for Financial Data Aggregators

Data aggregators have had to invest heavily to adapt their businesses and technology to meet the emerging security, consent management and fintech registration requirements imposed by the various Open Finance specifications and regulations emerging worldwide.

As FDX becomes widely adopted in North America, aggregators will need to securely connect fintechs to financial institutions per strict specifications, which will require continual additional investment to maintain. Cloudentity offloads this security and consent handling, so that aggregators can focus on aggregation.